What measures have been announced in Venezuela’s oil-producing states?

The attraction of investment coexists with urgent needs in infrastructure, public services, and operational capacity in the country’s main energy-producing states.

Understand how the Venezuelan economy moves.

The attraction of investment coexists with urgent needs in infrastructure, public services, and operational capacity in the country’s main energy-producing states.

The Government reported new progress within the framework of the 14 engines of the Bolivarian Economic Agenda. Photography: Presidential Press….

The U.S. military intervention in Venezuela and the capture of Nicolás Maduro have carried enormous political and symbolic weight. However, for major Wall Street players, the episode has not, for now, altered the core dynamics of global markets. BlackRock and JPMorgan agree that the Venezuelan case fits into a more fragmented world, but without the immediate capacity to generate systemic financial contagion.

The acting president led the 2026 National Council of the Productive Economy, where she reaffirmed the economic program launched in 2018, announced the channeling of oil revenues into the foreign-exchange market through private banks, and formalized the creation of two sovereign funds aimed at social protection and infrastructure, amid sustained economic growth and an international financial realignment.

Chinese government officials and representatives of the country’s main state-owned banks have initiated contacts with both Venezuelan authorities and U.S. officials to secure repayment of billions of dollars in loans granted to Caracas, in a context marked by the capture of Nicolás Maduro by U.S. forces and the political reordering underway in Venezuela, according to Bloomberg.

U.S. Secretary of Energy Chris Wright defended Washington’s strategy toward Venezuela: allow trade with Beijing, but prevent China from becoming the dominant player in the South American country’s oil economy. In an interview with Fox Business Network, Wright stated that there is “room to balance” U.S. and Chinese interests in Venezuela, but he made it clear that the United States will not accept China exercising strategic control over the Venezuelan economy.

Recent announcements have opened a new phase regarding the fate of the South American country’s crude oil on the global…

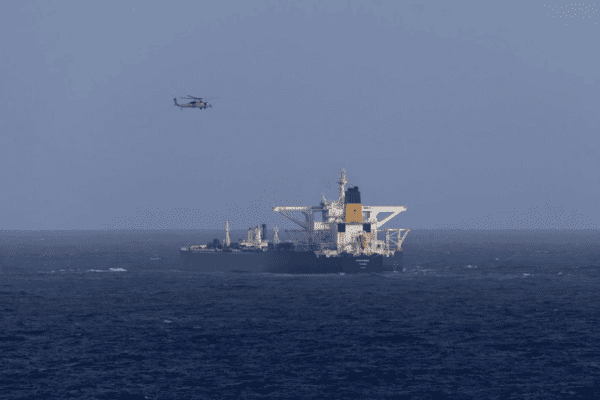

A U.S. military helicopter flew over the Centuries, a Panama-flagged vessel that was intercepted on Saturday east of Barbados in…

In its latest report, the Organisation of Petroleum Exporting Countries (OPEC) showed that Venezuela’s crude oil production fell by 2.8% to 934,000 barrels per day in November, according to “secondary sources.”

The United Nations Development Programme (UNDP) estimates that the Venezuelan economy will end the year 6.9% above 2024 levels, while inflation could reach 500%.