Alberto Maresca is a PhD Fellow at UNU-CRIS and Ghent University.

Guacamaya, February 4, 2026. Operation Absolute Resolve holds significant implications for global oil supplies. Despite being an important source for crude-heavy oil worldwide, in recent years Venezuela lacked the capacity for augmenting oil exports, largely because of US sanctions. The OFAC license 41B granted to Chevron was the sole option for Venezuela’s company PDVSA to obtain oil revenues from US companies. Currently, most of the Venezuelan oil sells at a $25 discount to the Brent benchmark. In order to attracting buyers, Venezuela used to massively discount its oil sales, while the Brent crude prices recently tended to oscillate around $60 per barrel.

An important detail regarding Trump’s strategy for Venezuelan oil is the quantity of barrels that Caracas can produce. It is worth recalling that Venezuela and the US, through PDVSA, are currently examining a specific trade agreement to set oil exports for the incoming years. Trump already claimed that he will extract 30-50 million of oil barrels from the country. As of 2024, the Venezuelan government reported to produce 841.000 oil barrels per day (bpd), while OPEC’s estimates are located around 796.000 bpd. If we consider a median between Venezuela’s and OPEC’s calculation, we might conclude that Venezuela can produce about 818.500 bpd. Hence, Venezuela may produce 24,555.000 barrels per month, which would bring a rate of 8,962,575.000 per year. Such figures are much distant from Trump’s previsions.

Nevertheless, during the 1970s, without US sanctions, Venezuela was reported to have the capacity to ship 1.7 million bpd just to the US, before the nationalization occurred in 1976. Therefore, if fostered, the Venezuelan oil industry could, over a lengthy period, have the capacity to sustain Trump’s proposed rate of exports. From S&P Global, experts warn that to bring Venezuelan production back to even 1.5 million bpd would require investment in an estimated range of $5 billion to $30 billion. After the US ousting of Nicolás Maduro, Venezuela has been reported to have shipped 800,000 bpd, which could possibly increase after the new licenses issued by Washington’s Treasury.

Trump’s plans should not drive unrealistic wishes regarding Venezuelan oil. Structural deficiencies need to be carefully considered. As of 2023, EIA reports that Venezuela’s exporting capacity did not even rank among the top 10 worldwide. The US itself has a capacity of almost 22 million bpd. The key factor is surely represented by global oil prices. During the last 5 years, oil prices (Brent) tended to decline toward the current rate, around $60 per barrel according to Trading Economics. Globally, oil as a commodity is living a situation where supply exceeds demand, particularly driven by Saudi Arabia’s push for further production. For analysts, since US companies like Exxon, ConocoPhillips, and Chevron are already suffering the economic impact of low oil prices, there would be no incentive in entering the Venezuelan market given its instability, low oil producing output (1% worldwide), and high costs to innovate the oil industry. Conversely, US oil companies could be attracted by the opportunity to diversify their investment portfolios through Venezuela, and their investments could be assured by Trump’s promise of halting Venezuelan oil exports toward China. It is also to be considered that low-carbon technologies, like solar panels and electric vehicles, have been progressively eating into fossil fuel demand, slowing oil and gas demand growth.

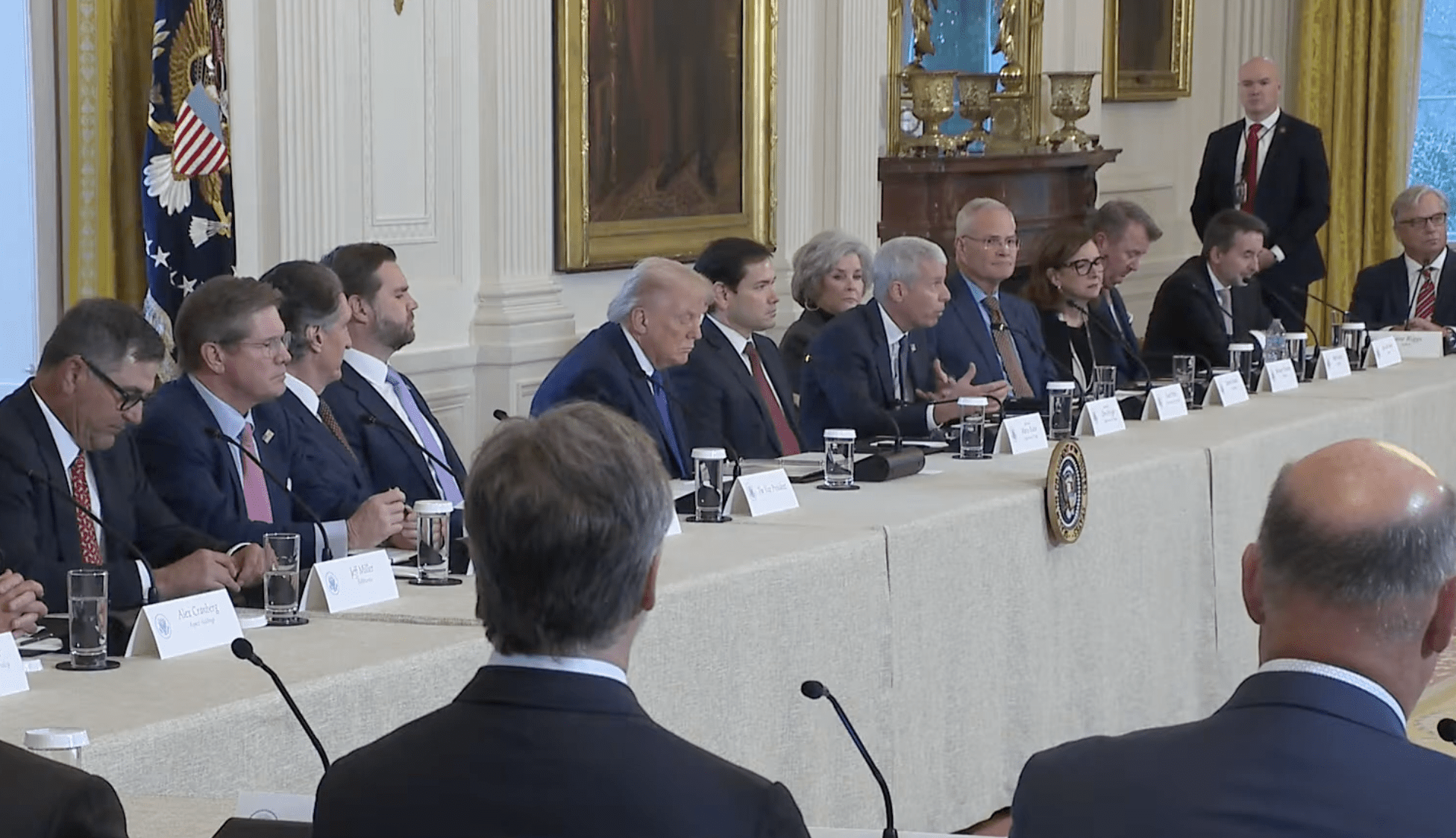

In conclusion, it appears that Trump’s claims about Venezuela and related oil consequences are not sustained by data. He rater relies on convincing oil companies to take the lead in the Venezuelan reconstruction, which has immense costs. The argument for which the Venezuelan operation relates to domestic politics seems more robust. As Will Freeman explained in Foreign Affairs, Trump is losing ground in Florida, where Miami just elected a Democratic mayor for the first time in nearly 30 years. Added to the backfire of Trump’s removal of the temporary migration status for Cubans, Venezuelans, and Nicaraguans, even opposed by some Florida-based Republicans, the rationale of the foreign policy toward Venezuela could find in oil simply a second motivation, with priority being given to the Floridian support for ousting Maduro.

Trump’s emphasis on Venezuelan oil is closely linked to electoral strategy, particularly in swing states like Florida. The US-based Venezuelan diaspora, concentrated in Florida, wields significant political influence, and foreign policy positions targeting Maduro resonate strongly with this electorate. As a result, oil-related policies may serve a dual purpose: presenting a tough-on-socialist image while securing domestic political loyalty, rather than achieving immediate strategic gains in global energy markets. In this sense, Operation Absolute Resolve appears to function as a symbolic policy tool, leveraging the promise of oil wealth to achieve broader political objectives rather than generating tangible increases in Washington’s energy provisions.