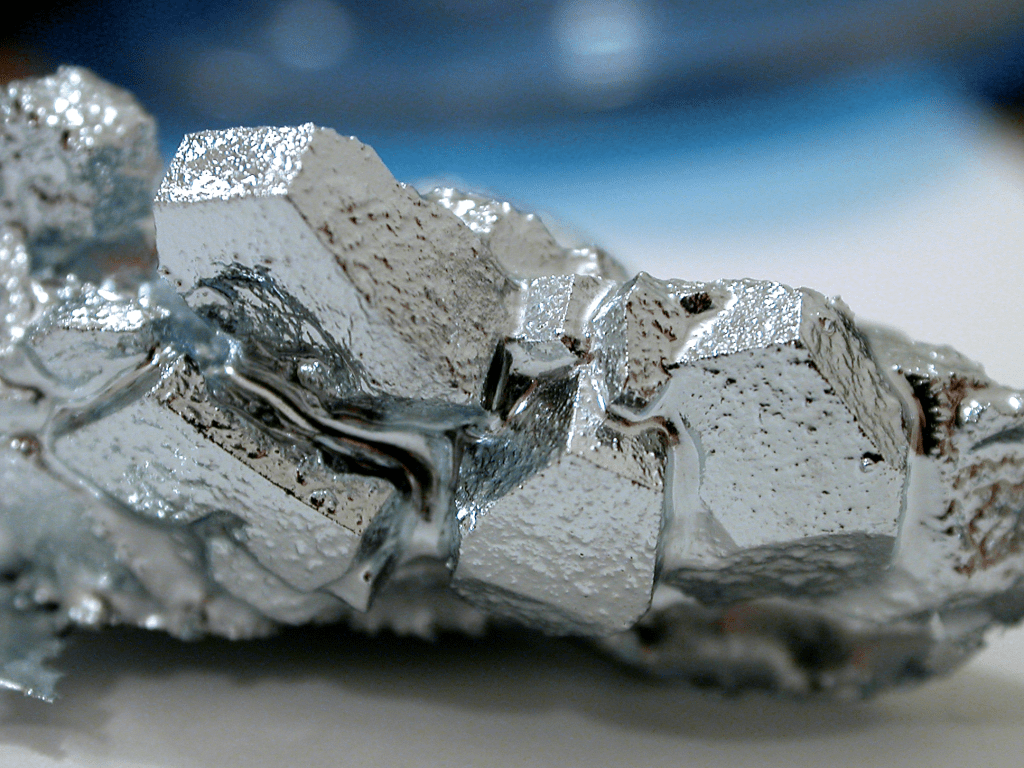

Gallium is a strategic mineral for the weapons industry, and Venezuela could have one of the world’s largest reserves, although it has never been exported. Photo: Foobar.

Jorge Barragán is an international analyst. He graduated from the Central University of Venezuela (UCV).

Guacamaya, February 3, 2026. A silent battle is raging worldwide for critical minerals. And there, in the heart of the Guiana Shield, Venezuela holds a piece that could alter the hemispheric security chessboard. We are talking about gallium.

What is Gallium and Why Should We Care?

Gallium is not the type of mineral you’d see in a jewelry store, but it is what enables world powers to develop their military defense capabilities in an anarchic international system where hard power prevails over rules.

This soft, silvery metal has become indispensable: it is the basis for Gallium Arsenide (GaAs) and Gallium Nitride (GaN), compounds that allow electrons to travel at speeds traditional silicon can only dream of.

For the United States, gallium is not an option; it is a matter of military survival. Without it, the Active Electronically Scanned Array (AESA) radars on F-35 fighter jets would lose their long-range “vision,” electronic warfare systems would fall silent, and precision-guided missiles would lose their brain. As CSIS analyst Aidan Powers-Riggs aptly notes:

“Gallium has become a geoeconomic weapon. It’s not just a mineral; it’s the heart of modern defense.”

Gallium holds immense strategic value; this little-known metal is crucial for advanced electronic warfare systems. The United States does not produce gallium domestically and lacks government stockpiles, as established in an Atlantic Council analysis.

China’s Iron Fist

This is where the plot thickens. Currently, China not only owns the mines; it possesses the will to use them as leverage. Beijing controls approximately 98% of the world’s gallium refining. It’s not that the mineral is scarce elsewhere on the planet; it’s that China has perfected the processing infrastructure and the chemical resins needed to extract it as a byproduct of bauxite, at prices that have suffocated any Western competition.

In late 2024, China sent a clear message by banning gallium exports to the U.S. Although a “tactical truce” in January 2026 has allowed certain flows until November. The Pentagon knows that depending on an adversary for its radar chips is, in strategic terms, suicidal negligence.

Venezuela: Gray Gold Beneath the Red Mud

Geologist José Joaquín Bogarín, the first Venezuelan researcher to formalize theses on critical minerals, points out that the country sits on an “unexplored potential.” Bogarín highlights that, beyond the 350 million certified tons in Los Pijiguaos, the development of projects to process red mud—a historically discarded residue rich in aluminum and other elements—could allow current reserves to grow significantly, positioning Venezuela on a higher scale of the global geoeconomy. In fact, some reports place the total geological potential of bauxite in the country at 6 billion tons, which would be nearly 20% of the planet’s future supply.

But we must be blunt: the resource alone is nothing. The former glory of CVG Bauxilum and the logistics of CVG Ferrominera are now skeletons of an industrial capacity designed to produce aluminum, not to capture critical minerals. Venezuelan bauxite is rich in gallium, but that gallium is currently lost in the “red mud,” a polluting waste, because we lack the refining technology or the plants to perform the separation.

Gallium recovery rarely makes economic sense on its own; it can be viable when integrated into multi-product strategies. Alumina refining offers the fastest way to increase gallium reserves. In aluminum production, most gallium dissolves in the caustic liquor, while the rest binds to the red mud residue. China’s decision to install capture units turned its aluminum refineries into a strategic asset.

What Could Happen: The Strategic Pivot

If Venezuela manages, through strategic openness and legal and political security, to attract the necessary dollars to install gallium recovery circuits, the landscape would change dramatically. The country could have a colossal strategic position.

For Washington, a gallium supplier just a few days’ sail away in the Caribbean would be the dream of any military logistics planner. For Venezuela, it means entering the supply chain of the high-end semiconductor industry, a market where a kilogram of pure gallium is quoted in hundreds of dollars, not cents.

The question is not whether we have the mineral. The question is whether we will be capable of understanding our current position as a nation in the international system. Of generating the trust to attract the international capital that would allow us to develop this industry.

Works cited:

- CSIS (2025): Beyond Rare Earths: China’s Growing Threat to Gallium Supply Chains. [Powers-Riggs & Funaiole].

- Atlantic Council (2025): Solving the US military’s gallium dilemma. [Morgan D. Bazilian].

- Reuters / Mining.com (2025): US critical minerals list expands. [Andy Home].

- USGS (2025): Mineral Commodity Summaries: Gallium.