Pedro Elías Hernández is a journalist and political analyst.

Guacamaya, November 11, 2025. We Venezuelans underwent a monetary reform starting in 1939 with the creation of the Central Bank of Venezuela (BCV), which from its foundation until 1974 (when it was fully nationalized) was a semi-private institution, constituted with private shareholders in addition to the State. Previously, since 1918, a Currency Law had been in effect, which created the bolívar-gold as the official currency of the republic. The legislation established that one bolívar was equivalent to 0.29 grams of fine gold; therefore, bolívars in circulation had mandatory backing and free convertibility into minted gold or gold bars. In other words, a classical gold standard was established in our nation.

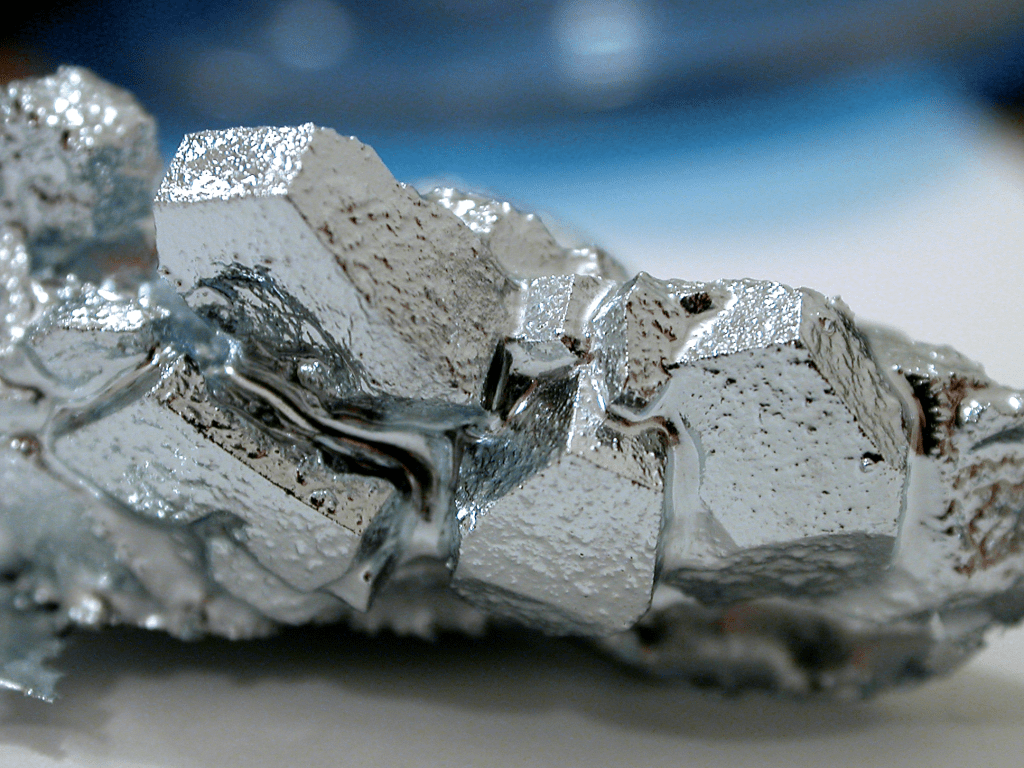

The gold that backed our bolívars was deposited in the vaults of the private banks existing at the time, which, until the creation of the BCV, had the authority to issue primary money. However, the bolívar-gold, as the Venezuelan monetary symbol, remained until 1974.

As a consequence of the aforementioned monetary reform, the gold belonging to the commercial banks based in the nation was expropriated, legal tender currency was issued, and Venezuelans were forced to exchange the bolívars in their possession—issued until then by various private banking entities—for the BCV’s bolívar. In this way, a single issuer of primary money was created, but with very rigid and precise emission rules, where the new bolívars had to be backed by gold or foreign currency based on a fixed exchange rate. This rigidity in the currency emission process is what allowed the existence of annual inflations lower than 2% on average for more than 30 years in the nation.

Such a system constituted, in fact, what is known as a “perfect currency board.” Currency was only issued if there was sufficient foreign currency or gold to back it. This model meant that the money supply adjusted to the demand for it. It really worked very well.

Unfortunately, over the years, the monetary emission rule was relaxed, granting the BCV greater discretion. This circumstance was consummated during the first government of Carlos Andrés Pérez with the nationalization of the Venezuelan issuing entity, which had been, since its foundation, a quasi-private institution with thousands of private shareholders.

That was the end of the stability and strength of the bolívar as a currency. The tragic history of what happened afterward with our national currency is well known. The currency that bears the name of the Father of the Nation has been devalued to the point of pulverization. An authentic monetary parricide was perpetrated. The problem in Venezuela is not that people don’t have enough money, but that the money doesn’t have enough value.

The Venezuelan drama is the interruption of a sustained process of monetary stability and economic growth that dates from 1922 to 1977. During that period, the Gross Domestic Product per Capita multiplied almost five times, according to figures provided by Professor Asdrúbal Baptista in his “Quantitative Bases of the Venezuelan Economy 1830-1989.”

What did we have in Venezuela from 1922 until the mid-70s of the last century, a span during which we grew at the rates that Asian economies are growing today? Well, during that time there were two fundamental things: a vigorous private oil industry and a solid and stable currency. Certainly, the critical change occurs starting with the oil nationalization of 1975. On one hand, the rules for issuing primary money by the BCV were relaxed, and on the other, the external sector of our economy was nationalized. Before, the dollars from Venezuelan exports were in the hands of the private productive sector, both oil and non-oil, which were sold to the BCV, and the BCV, in order to issue and put bolívars into circulation, had to previously guarantee their backing in gold or foreign currency at a fixed exchange rate. That is, a currency board.

Then, during the 21st century, came the monetary reconversions, the famous confiscation of the “little billion” from international reserves, and the modifications to the BCV Law in 2005 and 2010, which finished burying the national monetary system.

To give an idea of the patrimonial confiscation we have suffered, we refer to 1960, when the base salary of Venezuelans was 8 bolívars per day. This was equivalent to approximately 2.50 US dollars at the exchange rate of the time. Today, that amount would be equal to about 22 dollars of income per day. Labor organizations in the country are requesting to raise workers’ salaries to more than 500 dollars per month. If this demand were achieved, national wages would only be brought to an amount close to what they were in 1960, meaning over 60 years of lost economic development.

In 1960, the salary in Venezuela was equivalent to 80% of the income of an average worker in the US. If the minimum wage in that country today is about 1,800 dollars per month, then, if that economic growth trend we had during the first 7 decades of the last century had been maintained and the strength of the bolívar preserved, the minimum income of Venezuelans today should be approximately 1,300 dollars monthly, double the highest in Latin America.

Another interesting fact is to remember that one 1960 bolívar was equivalent to 0.29 grams of fine gold. This means that, had the value of our currency been preserved, anchored to that precious metal, instead of paying more than 22,400,000,000,000,000 bolívars for one dollar today (by adding the 14 zeros that were removed through the various monetary reconversions to the national currency), it would rather be approximately 37 dollars that one would have to pay to obtain one bolívar, according to the international price of gold today. In this way, we realize the savage destruction of our monetary symbol.

It would be very interesting to recall Bolivarian doctrine, quoting a part of the Cartagena Manifesto which indicates the monetary causes of the fall of the First Republic:

“The dissipation of public revenues on frivolous and harmful objects; and particularly on salaries of a multitude of office workers, secretaries, judges, magistrates, legislators, provincial and federal officials, dealt a mortal blow to the Republic, because it forced it to resort to the dangerous expedient of establishing paper money, with no other guarantee than the forces and the imaginary revenues of the confederation. This new currency seemed, in the eyes of most, a manifest violation of the right of property, because they considered themselves stripped of objects of intrinsic value, in exchange for others whose price was uncertain, and even ideal. The paper money sealed the discontent of the stupid inland towns, which called upon the commander of the Spanish troops, to come and free them from a currency which they viewed with more horror than servitude.”

It would be interesting, in monetary matters, to move towards a system in which each citizen freely decides in which currency they want to hold their wealth or which currency or physical asset of value they want to use as money. This would lead us to a system of free currency competition, where many would choose the dollar. We could also return to a scheme like the one we had from 1918 to 1975 of a perfect currency board, maintaining a national currency issued by our Central Bank, but with an anchor and backing in foreign currency or a material asset, which could be monetary gold, taking advantage of our condition as a country with enormous gold reserves. That is, a sort of new bolívar-gold. In oil matters, to open the sector wide to national and international private investment. The Venezuelan State is not meant to be a business owner. It does much of what it should not and very little of what it should.