Fabián Campos is a Business Economist graduated from Universidad Metropolitana and Coordinator of Scenarios and the Multisector Business Survey at Datanálisis.

Guacamaya, September 2, 2025. “If I lower prices, I’m going to sell more,” “Business is slow, I’m going to have to reduce staff,” “I just need to cut costs and expenses to improve my profit margin.” We have probably heard a friend, family member, or acquaintance say one of these phrases (or some variation of them with a similar meaning) when “things are tough” with their business.

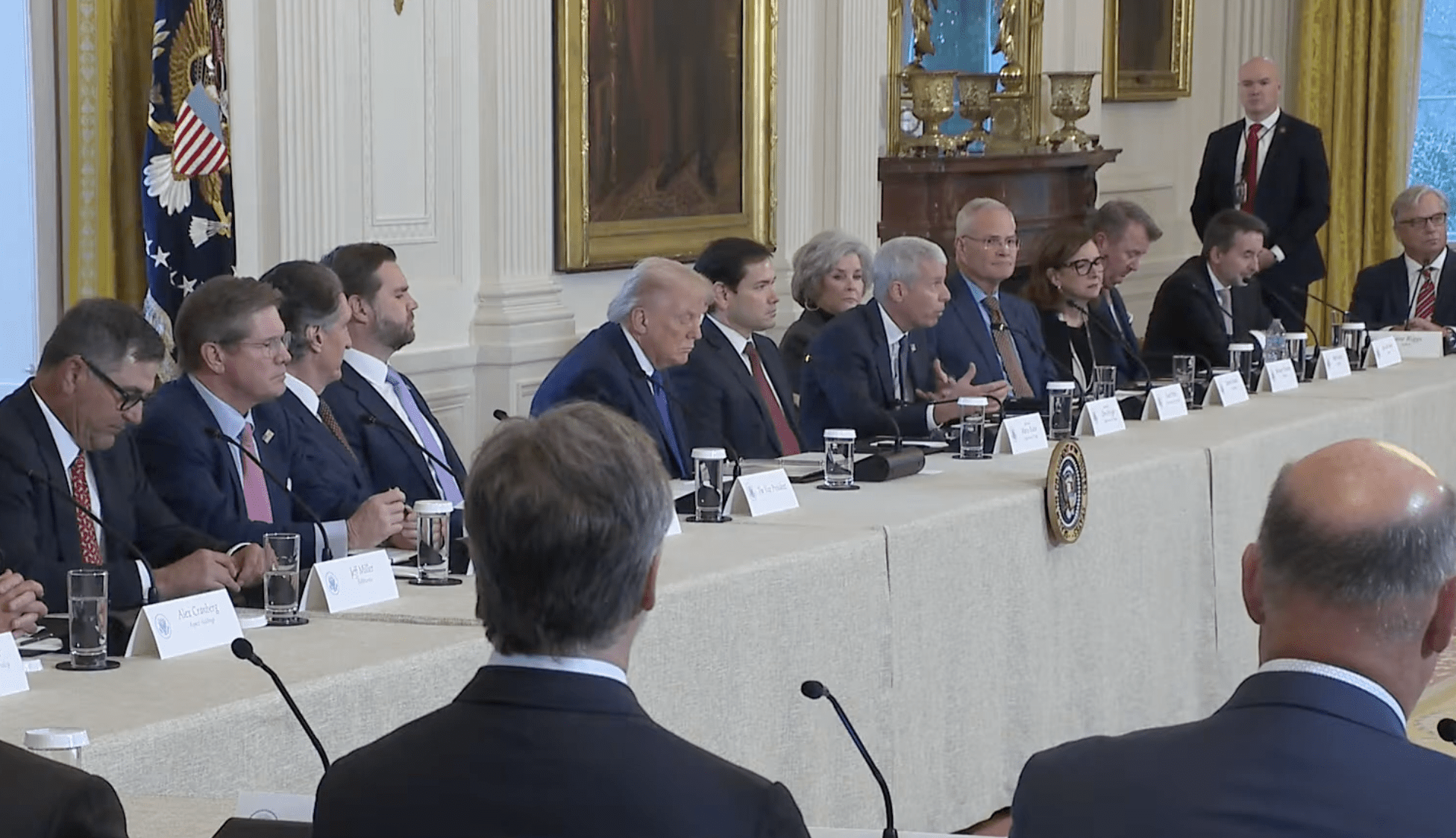

In one of the first editions of the Datanálisis Multisector Business Scenario Survey, in May 2021, just a few months after the official end of the country’s pandemic lockdown restrictions (“7×7”), we found an interesting result: Some companies, within the same sector and subject to one of the worst macroeconomic and international environment conditions in recent years (COVID-19), managed to grow their sales while others did not.

This finding prompted the question: Why do some companies grow sales under such difficult circumstances? The first answer business owners naturally give is the economic sector in which their company operates.

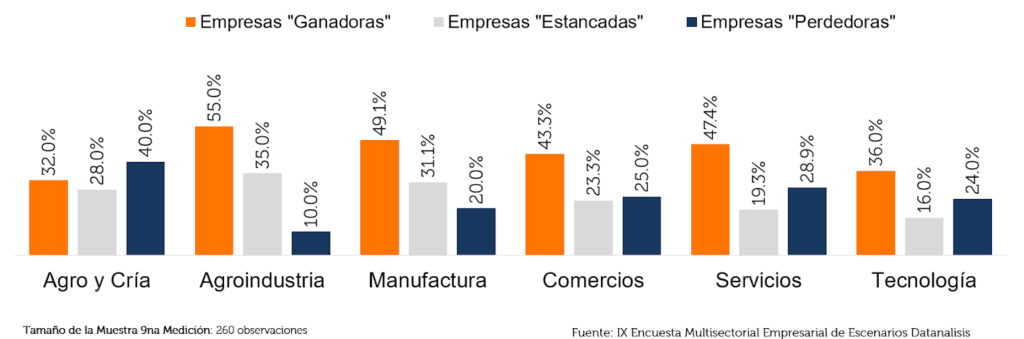

Obviously, one of the main characteristics of Venezuela’s economy today is its heterogeneity. There are sectors with more or less momentum; some grow while others do not; and some are characterized by a greater propensity to invest than others. However, when we analyze the main economic sectors in the survey, we find “winners,” “stagnant,” and “losers”1 in every segment.

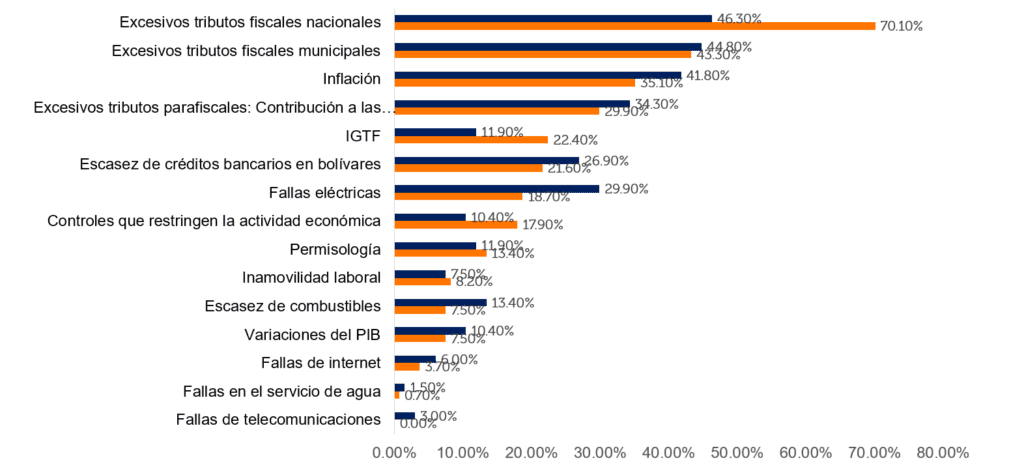

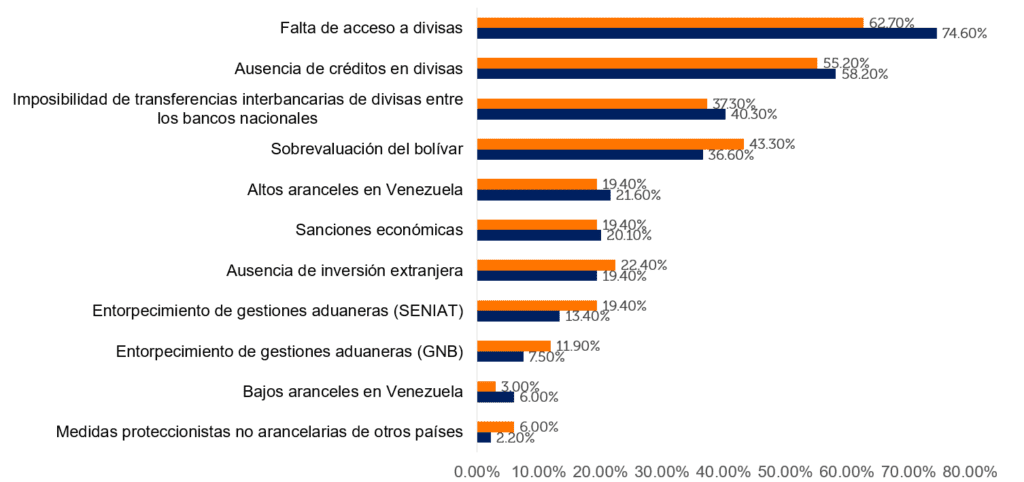

A second possible answer arises from environmental factors that hinder commercial activity. The argument here is that “losing companies” are “more affected” by the national and international economic environment.

When we compare the main factors that hinder commercial activity between companies that are “winning” or “losing” in Venezuela, with the exception of excessive national fiscal taxes—which weigh more on companies with growing sales (which is obvious)—we do not find significant differences between the two groups. In other words, the obstructive environmental factors are shared among companies.

Experience analyzing the dynamics of Venezuelan companies at the national level indicates that sales success is not attributed to “macroeconomic and international environmental problems” nor to the “sector to which the company belongs.” The key lies in strategies.

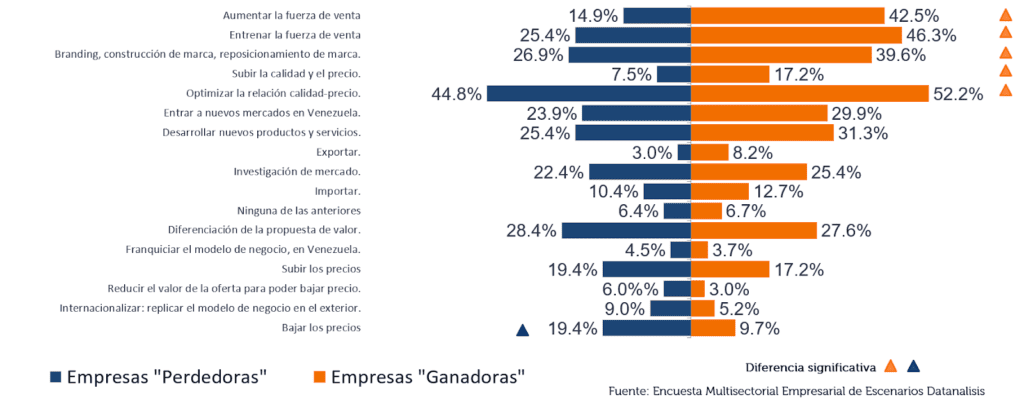

From the market perspective, “winning” companies are characterized by applying certain strategies significantly more than “losing” companies, such as: differentiation of the attributes that make up their offer, increasing the sales force, training the sales force, brand building (branding), raising quality and price, and optimizing the quality-price ratio.

“Losing” companies apply significantly more than winners a single strategy: lowering prices.

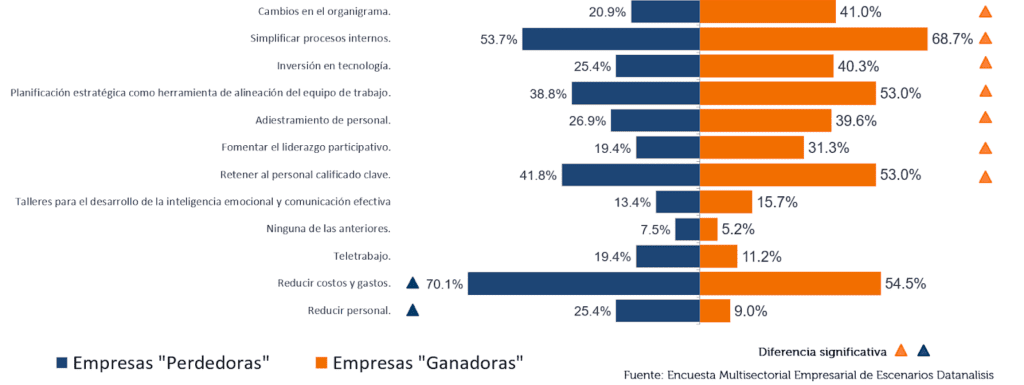

Analyzing internal company practices, winners: change their organizational charts, simplify processes, invest in technology, plan strategically, train their staff, and retain key qualified personnel more than losing companies.

Losing companies, on the other hand, are characterized by significantly more cost and expense reductions, and staff reductions than winners.

Therefore, contrary to what the “bad advice” says, lowering prices, cutting costs and expenses, and reducing staff do not constitute a recipe to sell more in Venezuela. In fact, just the opposite: these are the only three strategies applied significantly more by companies whose sales have decreased over the past twelve months.

This is not a criticism of the strategies per se, but of applying them in isolation: without a plan, without a clear direction, “just because,” or worse, “because that’s what I was told to do when things are difficult,” and without following a prior planning process or as part of one of many strategic activities within a business model update.

We will be discussing this with our main clients on November 4th at the Datanálisis anniversary event: “Venezuela: Present and Future, Consumer, Sectors, and Environment.”