Guacamaya, April 15, 2025. In a context of geoeconomic tensions and accelerating rhetoric around the energy transition, Russia has solidified its strategic roadmap for the energy sector through 2050. Approved in April 2025, this document not only redefines domestic priorities but also articulates a forceful narrative about the future of global power. Through the case of Rosneft, the state-owned oil giant, a structural challenge to the Western-led energy and financial model emerges, posing both a conceptual and practical test for the international order.

Context: Russia’s 2050 Energy Strategy in a Multipolar World

On April 14, 2025, the Russian government formalized an update to its energy strategy, extending its planning horizon to 2050. Presented by Prime Minister Mikhail Mishustin, the plan emphasizes adaptation to “global changes” through investments in critical infrastructure—from the Northern Sea Route to pipeline interconnections and market diversification in response to Western sanctions. According to Deputy Prime Minister Alexander Novak, the document anticipates a 20% increase in global energy demand by 2050, with hydrocarbons remaining a cornerstone.

The Northern Sea Route: Pillar of Russia’s Energy Strategy Toward 2050

With the progressive melting of Arctic ice, the Northern Sea Route (NSR) has evolved from a line on Soviet maps into one of the most important strategic axes of Russia’s energy and geopolitical projection for 2050. This maritime passage, which runs along Russia’s Arctic coast from the Kara Sea to the Bering Strait, represents a combination of commercial opportunities, geopolitical influence, and military control.

A New Energy Corridor

Russia has bet on transforming the NSR into a “Northern Energy Highway,” enabling the transport of hydrocarbons from the Yamal Peninsula and other Arctic fields to Asia, particularly China. Thanks to global warming, transit along this route has become increasingly viable: seasonal ice diminishes year after year, extending the navigable window to potentially 8–10 months by mid-century.

In this scenario, Russia not only shortens export distances compared to the Suez Canal—saving up to 40% in time and costs—but also diversifies its routes and reduces dependence on Western-controlled corridors. This is especially relevant amid sanctions imposed since 2014 and intensified after the Ukraine war in 2022.

Infrastructure and Strategic Investments in the Arctic

The Kremlin has heavily invested in port infrastructure, nuclear icebreakers, and energy projects like Yamal LNG and Arctic LNG 2, which form the core of its Arctic strategy. Novatek, Rosneft, and Gazprom lead these initiatives, backed by foreign investment—primarily from China.

Additionally, Russia is promoting Special Economic Zones along the route to attract foreign capital and develop Arctic cities like Murmansk, Tiksi, and Sabetta. Moscow aims not only to exploit resources but also to economically capitalize on the Arctic and solidify its long-term presence.

China: The Silent but Key Partner

Despite not being an Arctic power, China has skillfully inserted itself into this dynamic through its “Polar Silk Road” concept. Since 2018, Beijing has considered the NSR part of its ambitious Belt and Road Initiative, seeking more direct access to Europe and new channels for energy imports.

Chinese firms like CNPC, COSCO, and the Silk Road Fund actively finance and operate energy projects in the Russian Arctic. This symbiotic relationship allows Russia to access technology, financing, and Asian markets, while China secures energy supplies and avoids vulnerable maritime routes like the Malacca Strait, indirectly controlled by the U.S. This gains even greater relevance amid trade wars and escalating tensions with Washington.

NATO’s Role: Confrontation with Russia

In response to Russia’s Arctic advances and the growing Sino-Russian alliance, NATO has intensified its northern presence. The accession of Finland and Sweden has transformed the Arctic’s strategic map, nearly placing the entire region under Atlantic influence—except for Russia’s portion.

Military exercises like Cold Response and Arctic Forge demonstrate NATO’s commitment to strengthening Arctic operational capabilities. Concerns also persist that Russia could militarize the NSR or restrict Western access by requiring Russian pilots or special permits—contradicting U.S. and NATO principles of freedom of navigation.

Greenland: The Geostrategic Linchpin of the Western Arctic

Greenland is more than an ice sheet: it’s an Arctic observatory, a military platform, a natural resource reserve, and a geopolitical shield. U.S. ambitions over the territory stem from the need to “contain Russian influence” on the NSR and counter China’s quiet penetration into the Arctic.

The U.S. has operated the Thule Air Base in northwest Greenland since the Cold War. It remains a key site for missile defense and space surveillance. Today, Thule’s value grows as a monitoring hub for the NSR and any Russian or Chinese military activity. This has sparked tensions between Washington and its allies, while Russia sees an opportunity to buy time for its strategic plans—evidenced by Putin’s tacit support for U.S. positions on Greenland.

In the Arctic chess game, Greenland is not the queen but a powerful rook—and all players are watching it closely.

Russia’s new energy strategy hinges significantly on the NSR, and NATO knows it. Tensions in the region are likely to intensify in the coming decades.

Space: A Strategic Ally in the Arctic

Though it may seem distant, space exploration and satellite technology are crucial for Arctic economic exploitation—especially for routes like the NSR. The Arctic’s harsh, inaccessible nature makes space a force multiplier for efficient development.

Russia has deployed satellites like Arktika-M to monitor polar weather and facilitate NSR navigation, aligning with its 2050 energy strategy. Moscow plans its own Arctic satellite constellation (similar to Starlink) for continuous data and communication coverage—key to its strategic success. This also explains Russian officials’ openness to resuming space cooperation with the U.S., particularly with Elon Musk, who is part of the Trump administration. These dynamics mirror implications for Ukraine peace negotiations.

With limited terrestrial infrastructure, satellite communications are essential for connecting oil platforms, ships, and research stations, coordinating logistics (from mining to energy distribution), and ensuring emergency response in hostile environments.

Companies like SpaceX, OneWeb, and Telesat compete to provide high-speed satellite internet in polar regions, potentially revolutionizing the Arctic’s digital economy. Russia recognizes this and has prioritized the NSR and Arctic in its updated energy strategy.

Why Space Exploration Matters for the NSR’s Economic Potential

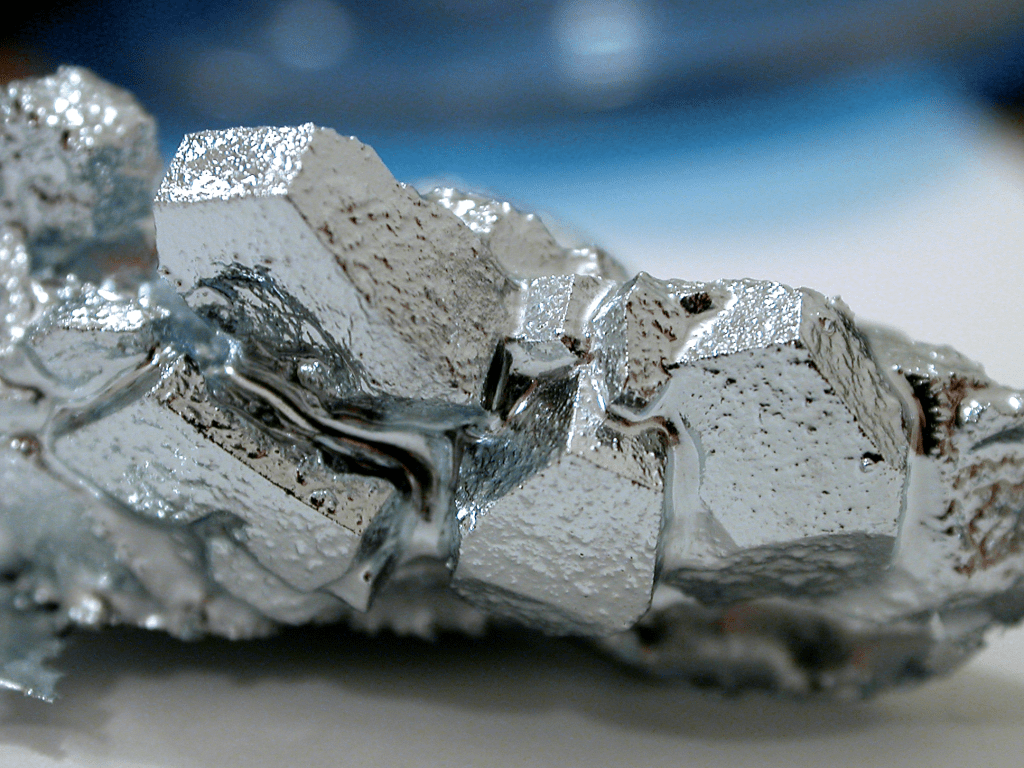

- Geological mapping via remote sensors helps identify oil, gas, rare earths, and other strategic mineral deposits without initial physical exploration.

- The ESA, NASA, and Roscosmos use satellite data to track Arctic climate change and forecast economic impacts.

- Russia is also building spaceports in Africa (near the equator) to boost satellite launches and compete in this critical arena.

In 2022, Russia signed a space cooperation deal with Venezuela. Latin America—especially the Guiana Shield region—holds significant potential for future space exploration, which will be decisive for Arctic economic development. The ESA’s spaceport in French Guiana underscores this. Territories like the Esequibo (subject to dispute) thus gain geopolitical relevance not just for resources but also as strategic hubs for space activities—a topic we will explore further in the future.

In short, whoever dominates satellite tech, orbital monitoring, and polar connectivity will control the far north’s economy—a key pillar of Russia’s energy strategy.

A Frozen Multipolar Chessboard

The Arctic is shifting from periphery to center stage in geopolitics. Russia sees the NSR as a tool to sustain its global energy power status, consolidate northern sovereignty, and project influence across Eurasia—its “natural sphere of influence”—while evading Western sanctions. China views it as a new trade corridor to integrate its economy while avoiding strategic vulnerabilities in the Indian Ocean and Indo-Pacific, where the U.S. is bolstering military presence via AUKUS.

NATO, in response, is rearming and repositioning to counterbalance Russia’s dominance in this critical region—though internal divisions persist, particularly over the Trump administration’s agenda and its territorial ambitions over Greenland (a Danish NATO member). The result is escalating competition, turning the Arctic into a new theater of global strategic rivalry where Russia has already laid out its blueprint.

This framework aligns with the analysis presented by Igor Sechin, Rosneft’s CEO, at the XVII Eurasian Economic Forum in Verona. Titled “Goodbye to Illusions: Global Energy in a Thucydides Trap,” Rosneft’s report synthesizes an alternative vision to the hegemonic green transition narrative, positioning Russia as a central player in 21st-century energy geopolitics.

Rosneft’s Narrative: Four Controversial Pillars

1. The Irreplaceability of Hydrocarbons

Rosneft argues that oil and gas—present in 95% of manufactured goods—will retain insurmountable technical advantages until mid-century, citing 30–45% greater energy efficiency than renewables and lower logistical costs versus alternatives like hydrogen. Crucially, existing global infrastructure (pipelines, refineries, distribution networks) offers a structural edge over emerging technologies.

2. The Accelerated Decarbonization Mirage

The report questions the feasibility of global climate goals, highlighting three obstacles:

- Technological: Dependence on critical minerals (75% controlled by China) and energy storage limits.

- Economic: The Global South cannot afford the $4 trillion annual renewable investments needed by 2030 (per IEA estimates).

- Environmental: Ecological damage from mining for EV batteries.

3. The Decline of the Dollar and Counterproductive Sanctions

Rosneft identifies a “vicious cycle” in U.S. policy: sanctions (applied to 12% of global GDP in 2023) erode dollar trust, accelerating its replacement by currency baskets, gold, or crypto. Notably, 25% of global reserves are now in non-traditional currencies, while U.S. debt exceeds 120% of GDP. Donald Trump echoed similar views during his campaign to justify outreach to Putin.

4. The Rise of a Multipolar Order

The document projects a fragmented international system anchored by BRICS+ and the Shanghai Cooperation Organization as counter-hegemonic blocs. Russia aims to position itself as an “energy security guarantor” for emerging economies, leveraging its status as the world’s top gas exporter and second-largest oil supplier. Moscow’s strategic plan aligns with this—including naval modernization. Trump also hinted at similar intentions upon taking office in January.

Rosneft’s report is crucial because it illustrates Russia’s future targets and worldview, revealing its desired role in the accelerating global reconfiguration shaped by current U.S. policies.

Russia’s 2050 strategy transcends energy: it is a geopolitical manifesto challenging Western narratives about the global order. Its success hinges on forging alliances across the Global South, while Latin America faces the challenge of navigating this rivalry without replicating historical dependencies. At stake is not just the climate’s future but the very structure of 21st-century power.

Venezuela, once again isolated by the West, will likely deepen ties with Russia—a key past ally in evading sanctions and maintaining oil production. Nicolás Maduro will visit Russia on May 9, 2025, following his recent October trip to Kazan for the BRICS Summit. He will attend the Victory Day parade, as confirmed by Sputnik Mundo.

In critical moments, Russia has been Maduro’s most important international backer. Now, with its expanded strategy, Venezuela is part of a larger equation in a global reshuffling where sanctioned nations historically deepen cooperative ties.