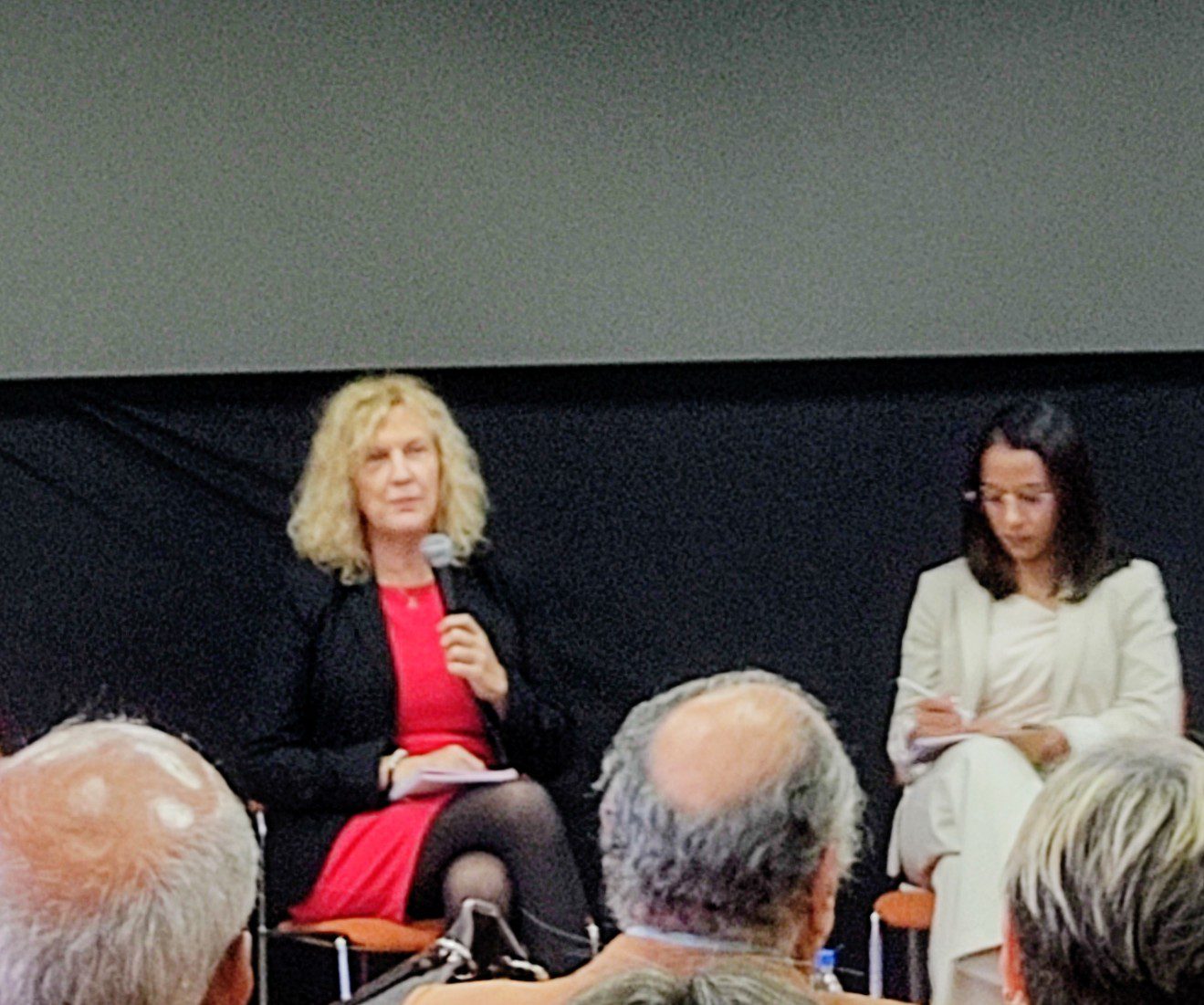

Delcy Rodríguez, interim president, alongside Ali Mohammed Hammad Al Shamsi, Secretary General of the UAE Supreme Council for National Security, with ministerial rank since January 2023. Al Shamsi also serves as president of the Federal Authority for Identity and Citizenship, Customs and Port Security, with ministerial rank since October 2021. Photograph: Presidential Press Office.

Guacamaya, January 19, 2026. Abu Dhabi’s state oil company, ADNOC, is evaluating a potential entry into Venezuela’s energy industry at a moment of profound political and economic reconfiguration in the country. The interest, revealed by Bloomberg News, coincides with an intense series of high-level diplomatic contacts between the United Arab Emirates (UAE) and Venezuela, as well as with the first announcements by the interim government regarding exports of liquefied petroleum gas (LPG). The move is unfolding under the close scrutiny of the United States, a key actor in any future architecture for energy investment in Venezuela.

ADNOC and XRG: preliminary interest, strict conditions

According to Bloomberg, ADNOC is considering participation in gas projects in Venezuela, potentially in partnership with another international producer. Sources familiar with the matter stress that the interest remains preliminary and is contingent on the existence of clear legal and financial structures that would ensure the viability of any investment.

Any approach by ADNOC to the Venezuelan market would require direct coordination with the United States and would be channeled through XRG, the Emirati oil company’s international growth platform. Bloomberg emphasizes that regulatory complexity, the sanctions regime, and the ongoing political transition make an explicit framework of understanding with Washington indispensable.

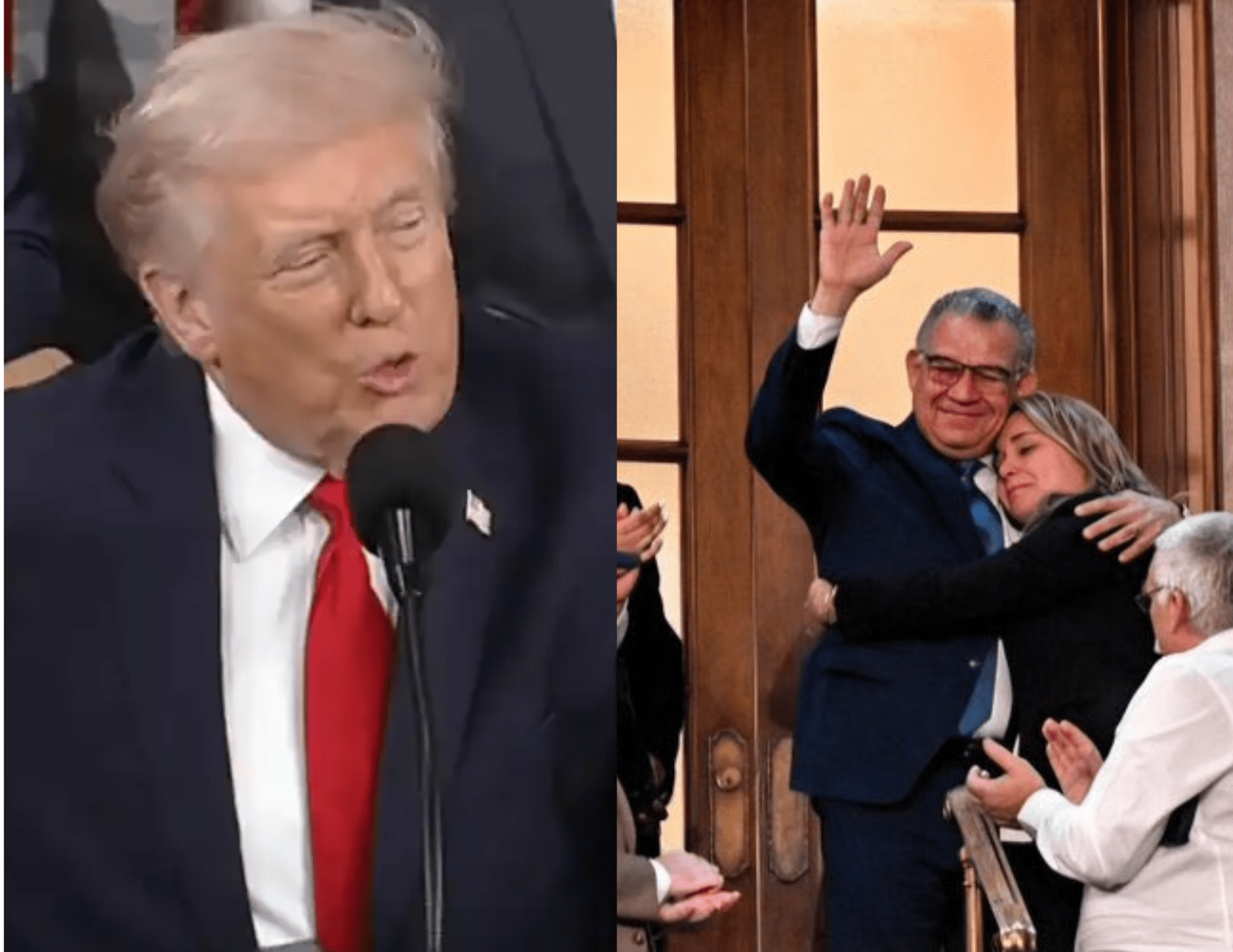

This point gains additional relevance following reports that U.S. President Donald Trump publicly urged American oil executives to invest up to $100 billion to revitalize Venezuela’s oil industry after U.S. forces captured Nicolás Maduro during a nighttime raid in Caracas on January 3.

ADNOC’s Global expansion and the strategic role of XRG

The potential interest in Venezuela fits into ADNOC’s aggressive international expansion strategy, led primarily through XRG. The platform already controls the German chemicals manufacturer Covestro and holds stakes in a liquefied natural gas plant in Texas, as well as several ADNOC subsidiaries listed on the Abu Dhabi Securities Exchange.

XRG has set ambitious long-term goals, aiming to rank among the world’s top three players in the chemicals sector and among the top five in natural gas by 2050. Since its launch just over a year ago, its assets have grown from more than $80 billion to over $150 billion.

In this context, Venezuela—with the world’s largest proven oil reserves and vast natural gas resources—emerges as a potentially strategic asset, provided that political, legal, and geopolitical risks can be cleared.

Accelerated diplomacy: high-level meetings between the UAE and Venezuela

The corporate interest coincides with a visible intensification of political dialogue between Abu Dhabi and Caracas. last tuesday, interim president Delcy Rodríguez held a meeting at the Miraflores Palace with a special envoy of the president of the United Arab Emirates.

The envoy was Ali Mohammed Hammad Al Shamsi, Secretary General of the UAE Supreme Council for National Security, with ministerial rank since January 2023. Al Shamsi is also president of the Federal Authority for Identity, Citizenship, Customs and Port Security, with ministerial rank since October 2021, and a member of several strategic councils of the Emirati state, including the Anwar Gargash Academy and the Federal Authority for Competitiveness and Statistics.

His profile combines experience in national security, border control, identity management, ports, and diplomacy. He previously served as ambassador of the United Arab Emirates to Jordan, Pakistan, and Afghanistan, and as a representative to regional and international organizations such as the Arab League and the United Nations.

On the Venezuelan side, participants included Vice President for the Economic Area Calixto Ortega, Foreign Minister Yván Gil, and then–Minister for Ecological Mining Development Héctor Silva. During the meeting, both delegations evaluated investment options across various productive sectors and promoted joint projects aimed at strengthening a diplomatic relationship with more than 50 years of history.

This meeting was followed, just days later, by a phone call between the UAE’s Deputy Prime Minister and Minister of Foreign Affairs, Sheikh Abdullah bin Zayed Al Nahyan, and his Venezuelan counterpart, Yván Gil Pinto. Both sides reviewed issues of mutual interest and discussed ways to expand cooperation across different sectors, with the explicit goal of supporting comprehensive development and sustainable economic prosperity in both countries.

Abdullah bin Zayed highlighted the UAE’s interest in further deepening bilateral ties “in all areas” and conveyed his best wishes for Venezuela’s progress and sustainable prosperity—a message that stands out in the context of Venezuela’s political transition and reinforces the perception of a deliberate strategic rapprochement.

Gas, exports, and an unprecedented signal

At the same time, during the National Productive Economy Council held on Friday, January 16, Delcy Rodríguez announced that Venezuela will export liquefied petroleum gas (LPG) “for the first time in its history.” The interim president reported that a commercialization agreement had been signed, without providing further details, and linked this step directly to the national hydrocarbons industry’s efforts to raise production levels.

Although it remains unclear whether this agreement is directly related to ADNOC or XRG, the announcement comes amid a context in which energy cooperation between Venezuela and the United Arab Emirates appears to be drawing closer in some form.

Beyond energy: the geopolitical dimension of the UAE–Venezuela relationship

The rapprochement between the United Arab Emirates and Venezuela must be read beyond the strictly energy-related dimension. For Abu Dhabi, Venezuela represents a strategic opportunity in a world shaped by geopolitical fragmentation and the reconfiguration of global energy flows. In recent years, the UAE has pursued a pragmatic foreign policy focused on diversifying investments, securing access to strategic resources, and positioning itself as an influential actor both in the Global South and in Western markets.

For Venezuela, ties with the UAE offer a dual advantage. On the one hand, access to capital, technology, and global commercial networks that are non-Western yet acceptable to Washington. On the other, a pathway toward gradual economic normalization that does not rely exclusively on U.S. or European companies, but rather on actors experienced in operating within politically complex environments.

The key condition remains the United States. Bloomberg’s emphasis on the need for coordination with Washington suggests that the UAE is positioning itself as a bridge actor—capable of investing while also aligning with the new geopolitical parameters set by the White House after January 3.

In this sense, the UAE–Venezuela relationship could become a laboratory for a post-Maduro Venezuela, marked by an attempt to establish a selectively open economy and by partnerships that combine financial muscle, diplomatic pragmatism, and a low ideological profile.