Recent announcements have opened a new phase regarding the fate of the South American country’s crude oil on the global energy stage. Photography: Repsol.

Guacamaya, January 7, 2025.- In the past hours, Venezuela has been placed at the center of the international energy agenda. With the recent U.S. military operation in the country that culminated in the capture and extraction of President Nicolás Maduro last Saturday, the North American nation has advanced within a framework of sustained pressure on Venezuelan oil. Warnings, seizures, and diplomatic demands—alongside new negotiation spaces—have reconfigured, in just a few days, the regional energy landscape.

Under the interim presidency of Delcy Rodríguez, Venezuela shows resilience and interest in sustaining production while seeking alternative commercial outlets, conditioned by diplomatic and trade agreements.

Since Wednesday, Washington has intensified actions to supervise and commercialize Venezuelan crude, warning that it will “indefinitely” control the sale of this resource. Revenues are expected to be deposited in accounts managed by Washington to “benefit the Venezuelan people” and drive political change in the nation.

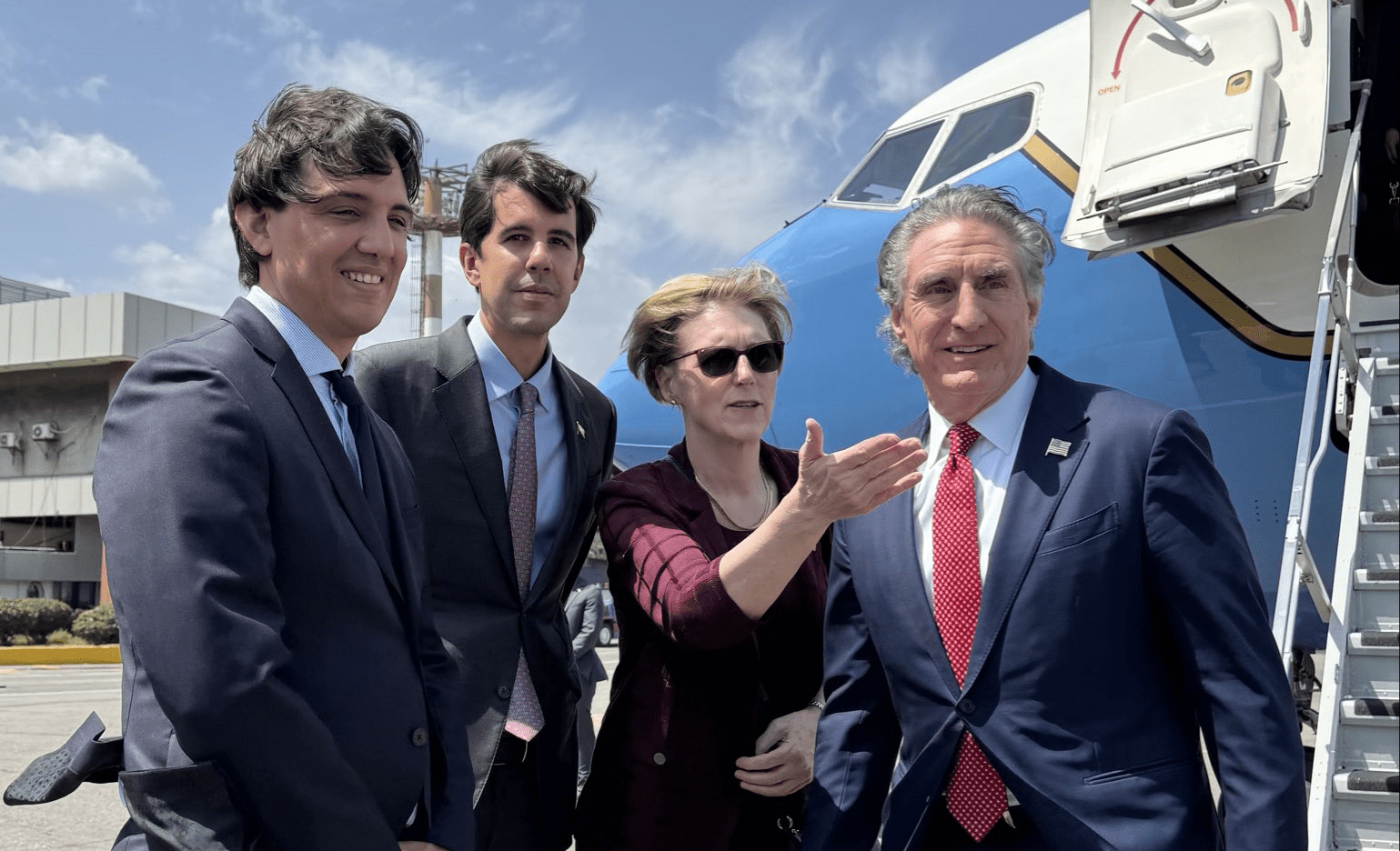

“We are going to put Venezuelan crude on the market—first this oil that is stuck, and then, indefinitely, moving forward, we will sell Venezuela’s production in the market,” said Chris Wright, U.S. Secretary of Energy, during a Goldman Sachs energy conference in Miami.

Wright emphasized direct cooperation with Venezuelan authorities after Maduro’s capture, allowing crude sales under U.S. supervision. Venezuela is expected to deliver between 30 and 50 million barrels in storage vessels for sale in North American markets, according to a prior announcement by President Donald Trump. Wright also projected that within 18 months, U.S. oil companies will reactivate Venezuela’s sector, increasing production from the current 800,000–900,000 barrels per day to “several hundred thousand more,” despite “previous mismanagement.”

Venezuela holds the world’s largest oil reserves—17% of the global total—but contributes barely 1% of production.

Pressures and Demands Continue

U.S. officials cited by ABC News indicated that Trump demanded Venezuela cut ties with China, Russia, Iran, and Cuba as a condition for extracting and selling its oil, prioritizing exclusive relations with the United States. The communication was reportedly directed to interim president Delcy Rodríguez, who, according to Secretary of State Marco Rubio, had “only a couple of weeks” to sell her stuck reserves before financial insolvency.

Senator Roger Wicker confirmed that the plan focuses on oil control without deploying additional troops. Although conditions and scope may vary, Washington’s intention is clear: to reconfigure Venezuela’s geopolitical alignment as a prerequisite for easing or normalizing trade relations.

Meanwhile, the U.S. Coast Guard intercepted the Russian-flagged tanker Marinera (formerly Bella 1), part of the so-called “ghost fleet” linked to illicit Venezuelan crude, after a nearly three-week chase in the Atlantic. The operation occurred without sightings of nearby Russian ships, though Moscow had deployed a submarine to escort the tanker.

Additionally, U.S. Southern Command reported intercepting the sanctioned tanker M/T Sophia in international Caribbean waters. The ship, sailing under a false Cameroonian flag, “had last docked in Venezuela or was heading there,” according to Homeland Security Secretary Kristi Noem.

These demands and interceptions underscore the continuation of an operational blockade aimed at halting Venezuelan oil circulation with its traditional partners. Such actions raise the logistical and financial costs of Venezuelan exports to chavismo’s allies, potentially pressuring Caracas to seek alternative routes or an imminent agreement with Washington.

Confirmed Agreements and Sanctions Relief

State-owned PDVSA confirmed ongoing negotiations with the United States for oil sales. In an official bulletin, the company stated the process “is based on a strictly commercial transaction, with legality, transparency, and mutual benefit,” suggesting a shift toward cooperation that may complement—or contradict—the narrative of pressure.

At the same time, White House spokesperson Karoline Leavitt announced that the U.S. is selectively lifting sanctions on Venezuela.

“The United States is cutting some sanctions to allow certain Venezuelan oil products to reach global markets,” she said at a press conference.

The supervisory framework may extend as long as sanctions and deterrence conditions persist. Continued operations against Venezuelan-linked tankers reflect the hardening of energy diplomacy, potentially forcing a redefinition of international alliances around Venezuelan crude.

Meanwhile, public negotiations indicate a dialogue channel that could lead to agreements conditioned on reforms, sanction relief, or supply guarantees. This may also signal Venezuela’s attempt to secure oil revenues amid persistent pressures, seeking fiscal stability and short-term liquidity during a political crisis following Maduro’s capture.

Substantial deliveries of Venezuelan oil to the U.S. suggest a reconfiguration of energy relations between the two countries. These developments point to an ambiguous, dynamic process with possible impacts on prices, export volumes, and diplomatic relations—requiring close monitoring in the coming hours and days.