Fabián Campos is a Business Economist who graduated from the Universidad Metropolitana and Coordinator of Scenarios and the Datanálisis Multisectorial Business Survey.

Guacamaya, October 12, 2025. In the previous article, “Strategies of Winning Companies,” we highlighted that the explanation for company growth in Venezuela is not attributable to environmental conditions or their economic sector, but to their implementation of strategies. One of these “Winning Strategies” is securing sources of financing.

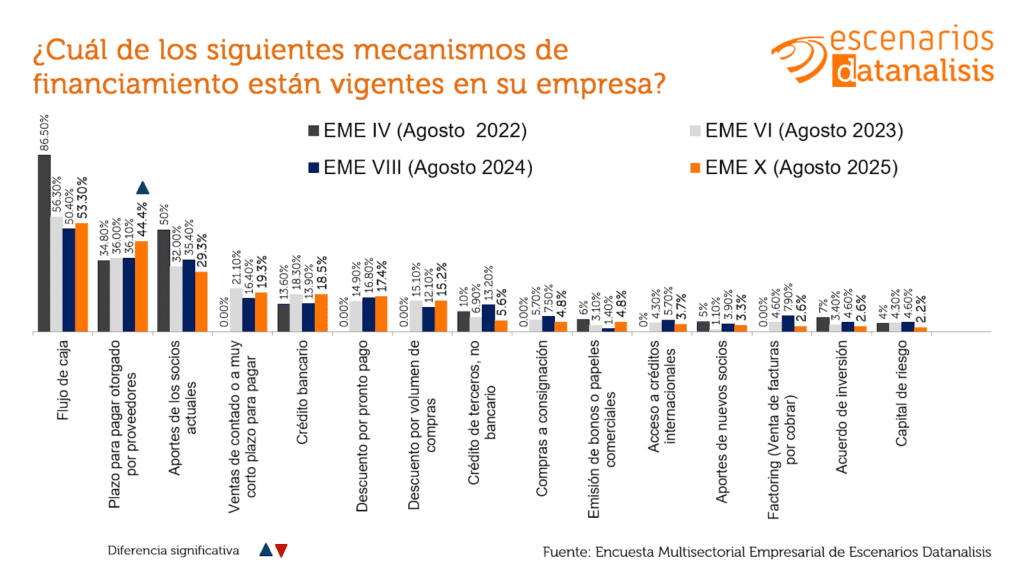

According to the results of the 10th Datanalisis Scenarios Multisectorial Business Survey, the top 3 financing mechanisms for companies are: Cash Flow, Payment Terms granted by suppliers, and Contributions from current partners.

Although this top 3 of financing mechanisms has maintained its position since August 2022, the evolution of the “number of mentions” shows an interesting result: The availability of Cash Flow and Contributions from current partners show a downward trend, while Payment Terms granted by suppliers is the only financing mechanism that shows a significant increase.

The above coincides with the behavior of the Venezuelan economy over the last year, characterized by an environment with price pressures, progressive devaluations, and a widening exchange rate differential. That is, precisely some of the elements of the macroeconomic environment that reduce business liquidity and solvency (“Cash Flow”) and generate distrust among economic actors have intensified, in many cases, discouraging internal investment (“Contributions from partners”).

Now, having described the financial environment for businesses in Venezuela, the question arises about the validity of “payment terms” as a financing mechanism in an economy where, literally, “time is money.” An approach to that answer may lie in three other financing mechanisms that have gained traction in Venezuela, especially in the last year: Very short-term sales, Volume purchase discounts, and Early payment discounts.

Combining this with the decrease in mentions of the availability of Cash Flow and Contributions from current partners as financing mechanisms, a first message seems to emerge: businesses in Venezuela are in a race for liquidity. And there are three factors that “validate” this strategy of “financing through liquidity prioritization”: 1. The dynamics of the financial and exchange environment (already described in previous paragraphs); 2. The scarcity of bank credit (which, although it has increased in the last year, still remains with a penetration of less than 20% (18.5%) and is concentrated in a few sectors); and 3. The slowdown in economic growth, which pressures customer demand downward.

But then, what explains that some suppliers, who play by “the same rules” and also see their liquidity affected, choose to grant attractive payment terms to their customers? Although it may sound counterintuitive, the answer may lie in the fact that they follow an alternative strategic approach: differentiation.

Returning to the concept of the strategies that characterize companies that grow in Venezuela, “differentiation of the value proposition” stands as the main strategy implemented by companies in the market environment. And this proposes an interesting approach, which we will be addressing in the following articles: What could be more effective for the Venezuelan company today… growing its business by price/margin or by volume?

In any case, by analyzing the behavior of more than 1,000 Venezuelan companies over the last 3 years, we have found an 80% correlation between the competitive differentiation approach and the increase in sales.

Hence, despite a constraint in the economic environment (which affects everyone, or almost everyone), differentiation in the service provided to the customer (e.g., attractive payment terms) may allow some to compensate for a potential loss due to exchange rate distortion and devaluation (“price/margin”) with an increase in their market share (“volume”). Without any magic tricks or use of privileged information, simply by thinking about “how can I solve a problem for my customer, in the same way I would like it to be solved for me.” In some of these cases, “the numbers add up.”

At the Datanalisis 40th-anniversary event, next November 4th in Caracas, we will be delving into some of these financing and differentiation strategies in the market together with our experts.